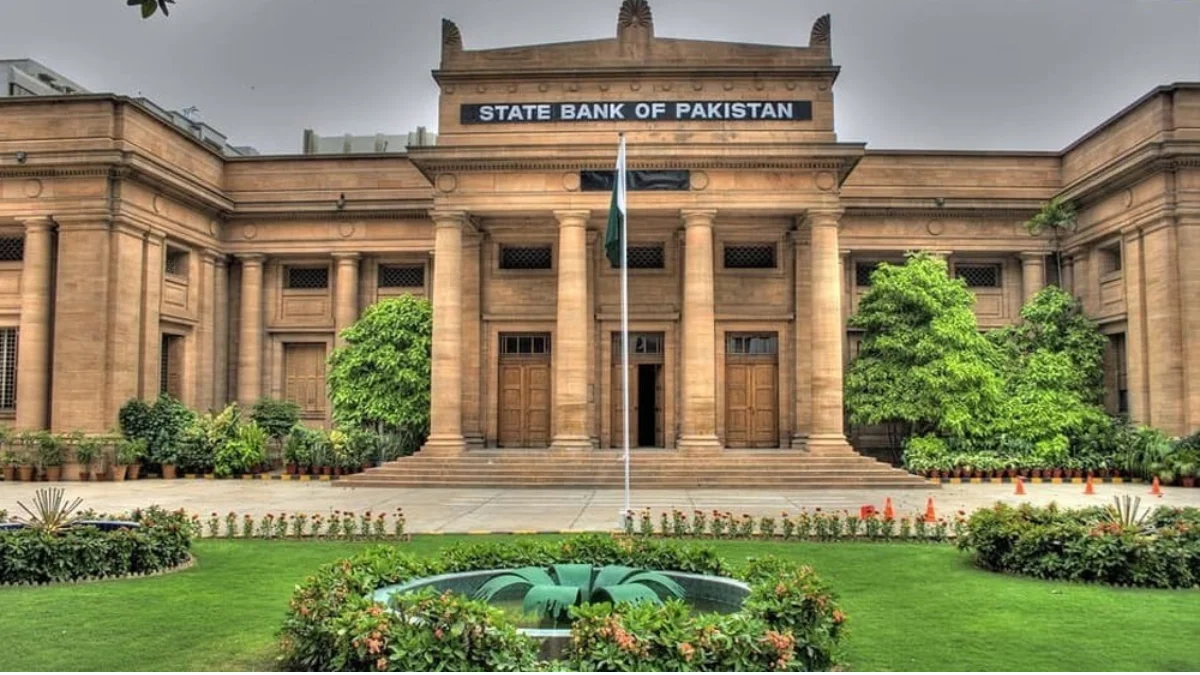

In a move aimed at promoting transparency and efficiency in the financial sector, the State Bank of Pakistan (SBP) has announced modifications to the reporting schedule for bank exchange rates. This decision reflects the central bank’s commitment to refining reporting mechanisms, ensuring accurate and timely information regarding currency exchange rates.

Key Points:

- Enhanced Transparency: The SBP’s adjustment of the reporting schedule is a proactive step toward enhancing transparency within the banking sector, providing stakeholders with more accurate and up-to-date information on currency exchange rates.

- Timely Information: The modified reporting schedule emphasizes the importance of timely reporting, enabling businesses, investors, and the general public to make informed decisions based on the most recent exchange rate data.

- Financial Sector Efficiency: By refining reporting mechanisms, the SBP aims to improve the overall efficiency of the financial sector. Accurate and promptly reported exchange rates contribute to the stability and reliability of financial transactions.

- Market Confidence: Transparent reporting fosters market confidence by reducing uncertainties associated with currency exchange. The banking sector’s commitment to timely and accurate reporting enhances the credibility of financial institutions.

- Alignment with Global Standards: The SBP’s initiative aligns with international best practices for financial reporting. Consistency with global standards strengthens Pakistan’s position in the international financial community.

- Impact on Businesses: Businesses engaged in international trade and finance benefit from reliable exchange rate information, aiding in risk management, financial planning, and decision-making processes.

- Public Awareness: The revised reporting schedule also contributes to public awareness, ensuring that individuals are well-informed about currency exchange rates and their potential impact on personal finances.

- Regulatory Compliance: Financial institutions are expected to adhere to the modified reporting schedule, emphasizing regulatory compliance. This ensures a standardized approach across the banking sector.

- Technological Integration: The move toward enhanced reporting also encourages technological integration within the banking system, streamlining the process of collecting and disseminating exchange rate information.

- Feedback Mechanism: The SBP remains open to feedback from stakeholders regarding the revised reporting schedule, fostering a collaborative approach to further improvements in financial reporting practices.

The SBP’s decision to revise the reporting schedule for bank exchange rates reflects a strategic commitment to transparency, efficiency, and regulatory compliance within the financial landscape of Pakistan. As the banking sector embraces these modifications, it is anticipated that the broader financial ecosystem will benefit from more accurate and accessible exchange rate information.