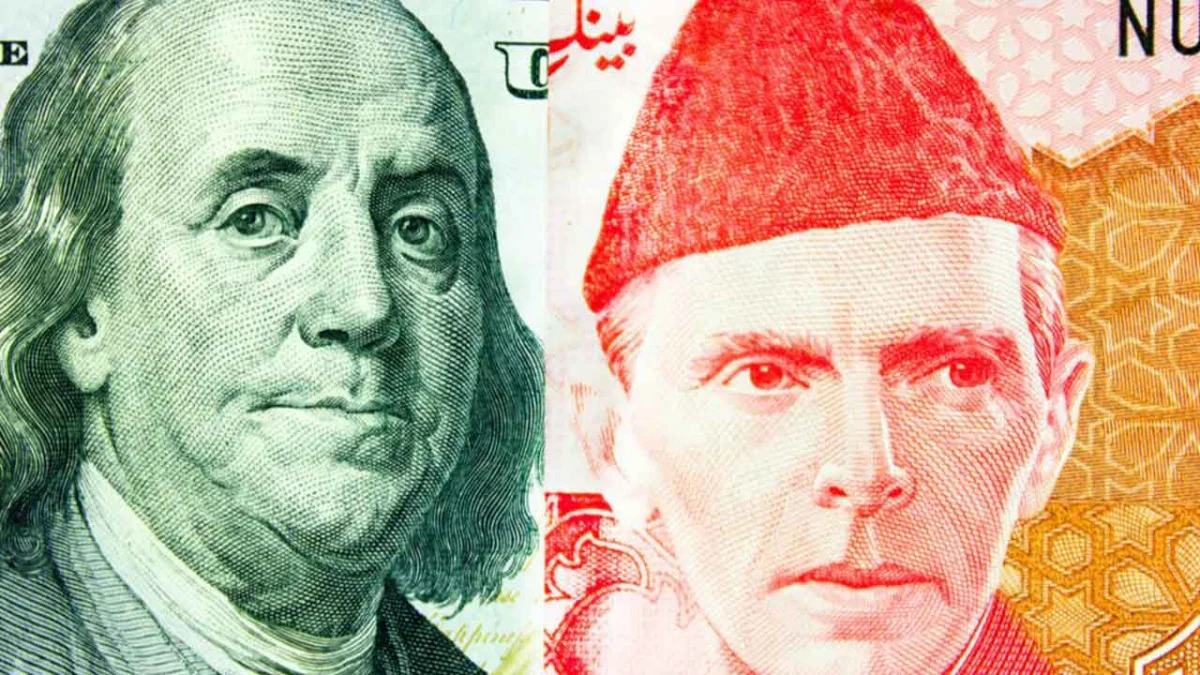

In the latest update on currency markets, the Pakistani rupee has shown a slight gain against the US dollar during intraday trading. This marginal uptick comes amidst ongoing fluctuations in market dynamics and economic uncertainties.

Key Points:

- Current Exchange Rate: The Pakistani rupee has experienced a modest increase in value against the US dollar in intraday trading, reflecting the latest developments in currency markets.

- Market Volatility: Fluctuations in currency markets are influenced by various factors, including economic indicators, geopolitical events, and investor sentiment. Today’s marginal gain underscores the volatility inherent in currency trading.

- Impact on Importers and Exporters: The exchange rate movement affects businesses engaged in international trade. Importers may find relief with a stronger rupee, reducing the cost of imported goods, while exporters may prefer a weaker rupee to enhance competitiveness abroad.

- Central Bank Role: The State Bank of Pakistan (SBP) plays a crucial role in managing currency market stability through monetary policy tools and intervention strategies aimed at curbing excessive volatility.

- Economic Outlook: Currency fluctuations reflect broader economic trends and investor confidence. Short-term movements, alongside long-term trends, provide insights into the economy’s health and global competitiveness.

- Global Factors: Exchange rate dynamics are influenced by global economic trends, US monetary policy changes, commodity prices, and geopolitical tensions, which collectively impact currency values.

- Investor Sentiment: Market participants closely monitor currency movements, adjusting their positions based on expectations of future trends. Investor sentiment can contribute to market volatility.

- Long-Term Trends: While intraday fluctuations are crucial for short-term traders, long-term exchange rate trends indicate overall economic health and competitiveness. Policymakers consider both short-term movements and long-term trends when formulating economic policies.

As trading continues, stakeholders will closely watch currency movements, with the performance of the Pakistani rupee against the US dollar remaining a focal point for investors, businesses, and policymakers.

Also Read: Tackling Pakistan’s Debt Quagmire: Strategies for Economic Resilience