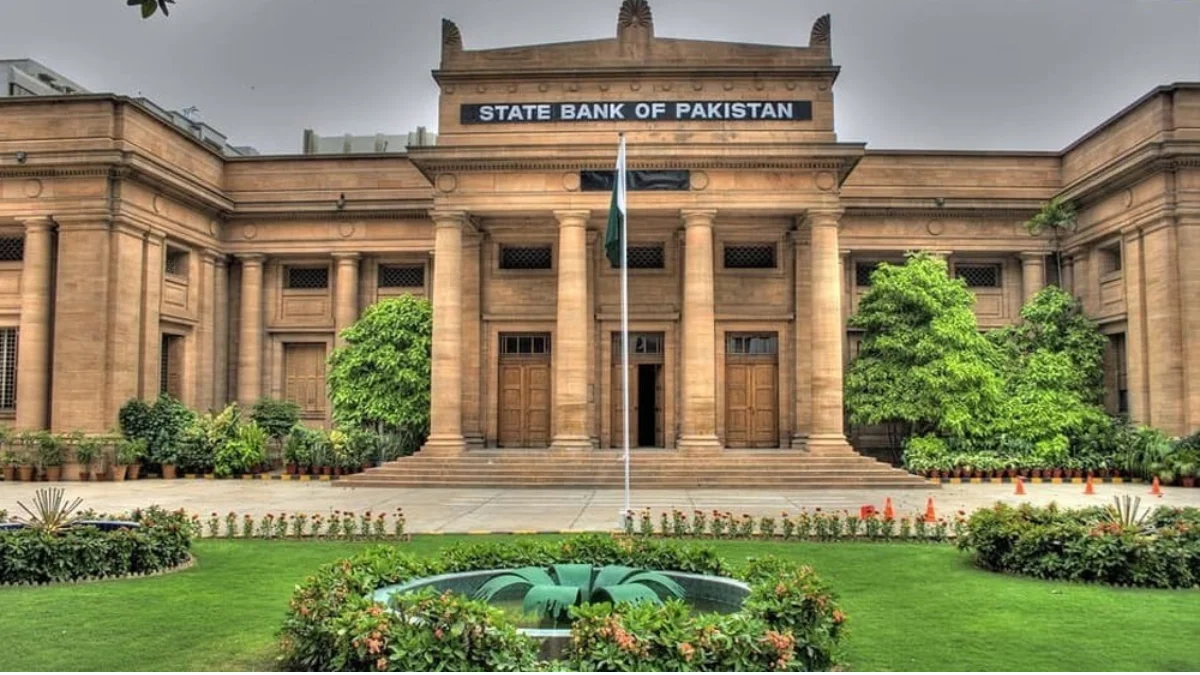

In a move aimed at fostering seamless communication and engagement, the State Bank of Pakistan (SBP) has officially launched its dedicated WhatsApp channel. This strategic initiative is designed to provide stakeholders, including individuals and businesses, with a direct and efficient channel for interacting with the central bank.

The launch of the SBP’s official WhatsApp channel comes as part of the central bank’s ongoing efforts to enhance transparency, accessibility, and communication with the public. By leveraging the widespread use of WhatsApp as a popular messaging platform, the SBP aims to create a more direct and user-friendly avenue for addressing queries, disseminating information, and fostering a closer connection with the public.

Individuals and businesses can now access the SBP’s official WhatsApp channel to stay informed about the latest updates, announcements, and regulatory changes in the financial landscape. This initiative aligns with the SBP’s commitment to providing timely and relevant information to the public, ensuring that stakeholders are well-informed about key developments that may impact their financial interactions.

The WhatsApp channel is poised to serve as a dynamic platform for two-way communication, allowing users to pose queries, seek clarifications, and receive prompt responses directly from the SBP. This real-time interaction capability enhances the overall user experience, making it easier for individuals and businesses to engage with the central bank and stay abreast of pertinent financial matters.

To further streamline communication, the SBP’s WhatsApp channel will also facilitate the dissemination of educational content, financial literacy materials, and important updates related to regulatory frameworks. This multifaceted approach aims to empower users with valuable insights, ensuring a more informed and financially literate populace.

As the SBP continues to embrace digital channels for communication, SBP Launched its official WhatsApp channel marks a significant step toward modernizing and enhancing engagement in the financial sector. Users can now leverage this accessible platform to connect with the SBP, receive personalized updates, and participate in a more interactive and informed financial ecosystem.

Also Read: Car Sales Experience Sharp 66% Decline in December